Examples of transitory gains and losses are those that arise on the remeasurement of defined benefit pension funds and revaluation surpluses on PPE. We note in Colgate that the Retirement Plan and other retiree benefits adjustments are – $168 million (pre-tax) and – 109 million (post-tax). Let’s take a different case where such gains and losses do not flow through the Income Statement. However, its total Comprehensive Income, including noncontrolling interests, was $2,344 million in 2016.

Comparative Financial Statements

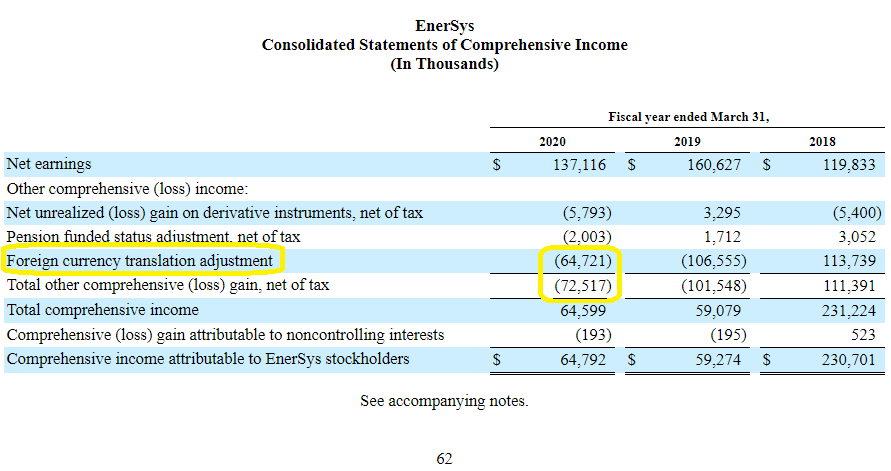

The income statements for P and S for the year ended 31 August20X4 are shown below. Looking at OCI can also lend insight into firms that operate overseas and either do currency hedging or have sizable overseas revenues. In our example above, MetLife’s foreign currency adjustment wasn’t overly large, but seeing it could help an analyst determine the impact of currency fluctuations on a company’s operations. For a U.S.-based firm, a stronger domestic dollar will lower the reported value of overseas sales and profits.

Notes to Financial Statements

Companies must regularly update their consolidated financial statements to reflect any changes in their subsidiaries or entities. This includes acquisitions, mergers, or structural changes that affect ownership or financial control. Maintaining up-to-date financial reports is crucial for ensuring consolidated statements of comprehensive income compliance and providing accurate financial data to stakeholders. In summary, consolidated financial statements consolidate the financial information of a parent company and its subsidiaries, allowing finance teams to gain insights into the group’s financial position, performance, and cash flows.

FAQs on consolidated financial statements

- Comprehensive income is the sum of that net income plus the value of yet unrealized profits (or losses) in the same period.

- However, those separate legal corporations (called subsidiaries) are owned and controlled by one of the corporations (the parent corporation).

- At the end of the statement is the comprehensive income total, which is the sum of net income and other comprehensive income.

- Many processes owned by the Office of the CFO are time-consuming and labor-intensive.

Creating consolidated financial statements can be time-consuming, especially when the Office of the CFO relies on legacy systems and manual processes. Like other publicly-traded companies, Ford Motor Company files quarterly and annual reports with the SEC. In its first quarter filing for 2023, it published its consolidated statements of comprehensive income, which combines comprehensive income from all of its activities and subsidiaries (featured below).

Importance of consolidated financial statements for finance teams

Non-controlling interest, also known as minority interest, represents the portion of equity in a subsidiary not owned by the parent company. It is separately reported in the consolidated financial statements to provide transparency regarding external shareholders’ stake in the subsidiary. Understanding the non-controlling interest helps stakeholders assess the subsidiary’s financial contribution to the group and evaluate its impact on the consolidated financial statements. Also known as the consolidated statement of comprehensive income, the consolidated income statement combines the revenues, expenses, gains, and losses of the parent company and its subsidiaries. This statement provides insights into the group’s overall profitability—including revenue, expenses, gains, and losses of the consolidated entity. Consolidated financial statements are a set of financial reports that present the combined financial information of a parent company and its subsidiaries.

Let us understand this concept with the help of a basic statement of comprehensive income example. Comprehensive income provides a complete view of a company’s income, some of which may not be fully captured on the income statement. In accordance with IFRS 8, operating segments are determined based on the reporting made available to the chief operating decision maker of the Group and to the Group’s management. Had the question asked for the cost of the investment that would be recorded in the parent’s books, this would be it – hence the inclusion of the distracter, and incorrect answer D. Illustration (4)Red Co acquired 80% of Blue Co’s 40,000 $1 ordinary share capital on 1 January 20X2 for a consideration of $3.50 cash per share.

The purpose of comprehensive income is to show all operating and financial events that affect non-owner interests. As well as net income, comprehensive income includes unrealized gains and losses on available-for-sale investments. It also includes cash flow hedges, which can change in value depending on the securities’ market value, and debt securities transferred from ‘available for sale’ to ‘held to maturity’—which may also incur unrealized gains or losses. Gains or losses can also be incurred from foreign currency translation adjustments and in pensions and/or post-retirement benefit plans.

Until inventory is sold to entities outside the group, any profit is unrealised and should be eliminated from the consolidated financial statements. The original logic for OCI was that it kept income-relevant items that possessed low reliability from contaminating the earnings number (profit for the year). The OCI figure is crucial however it can distort common valuation techniques used by investors, such as the price/earnings ratio. Misuse of OCI would undermine the credibility of the profit for the year figure and key investor ratios used by stakeholders to assess an entities performance. The use of OCI as a temporary holding for cash flow hedging instruments and foreign currency translation is non-controversial and widely understood. These will be reclassified in a future accounting period therefore impacting profit or loss.

However, the Financial Accounting Standards Board defines consolidated financial statement reporting as reporting of an entity structured with a parent company and subsidiaries. Companies that don’t have to produce consolidated financial statements may still choose to do so. Usually, this is for certain tax advantages or to provide a better picture of the entity’s overall financial position to investors. Contrary to net income, other comprehensive income is income (gains and losses) not yet realized. Some examples of other comprehensive income are foreign currency hedge gains and losses, cash flow hedge gains and losses, and unrealized gains and losses for securities that are available for sale.

A consolidated balance sheet, also known as a consolidated statement of financial position, combines the assets, liabilities, and shareholders’ equity of a parent company and its subsidiaries in a single document. For fully consolidated subsidiaries, their numbers are absorbed by the parent, making them part of the parent’s overall financials. Broadly speaking, consolidated financial statements are read similarly to unconsolidated statements. Depending on the type of statement, it might list assets, liabilities, or income on individual lines. For fully consolidated statements—where all a subsidiary’s assets and liabilities are rolled into the parent’s statement—there won’t be separate line items showing subsidiaries.